10 November 2020

by David Prichard

- Related topics

- Personal Tax & Superannuation

- Corporate Tax & Regulatory

One of the levers utilised by the Federal Government in its Budget was the re-introduction of the loss carry back rules. The general rules provide that losses can only be recouped looking forwards.

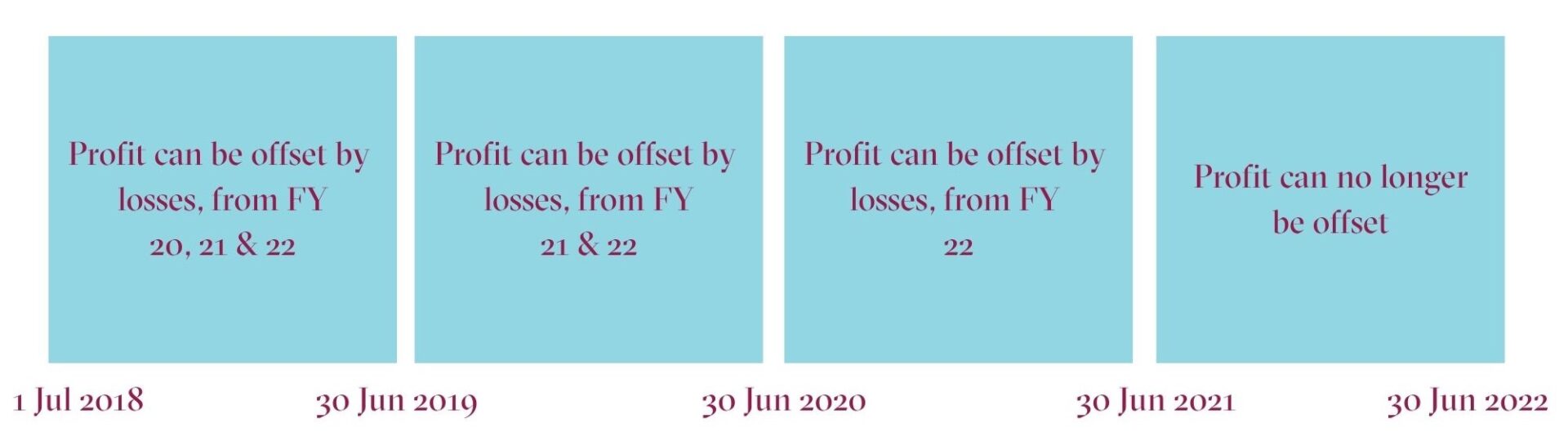

Under the change in law, companies with an aggregated annual turnover of less than $5 billion will be allowed to carry-back losses from the 2019/20 to the 2021/22 income years against taxable incomes from the 2018/19 to 2020/21 income years. This has been outlined in the below diagram:

To the extent that a loss that is carried back, it will generate a refundable tax offset in the year in which the loss is made. As such, based on the guidance provided, prior year returns do not need to be amended to obtain the benefit of the loss carry back. Rather, eligible companies can elect to claim the tax refund when they lodge their tax returns. In practical terms, this may mean that the refund of tax is offset against outstanding ATO liabilities rather than generating an actual cash refund.

When determining the amount of loss that can be carried back, the amount is limited by reference to:

- the amount of earlier taxed profits; and

- the level of the franking account (i.e. franking account deficit cannot be created).

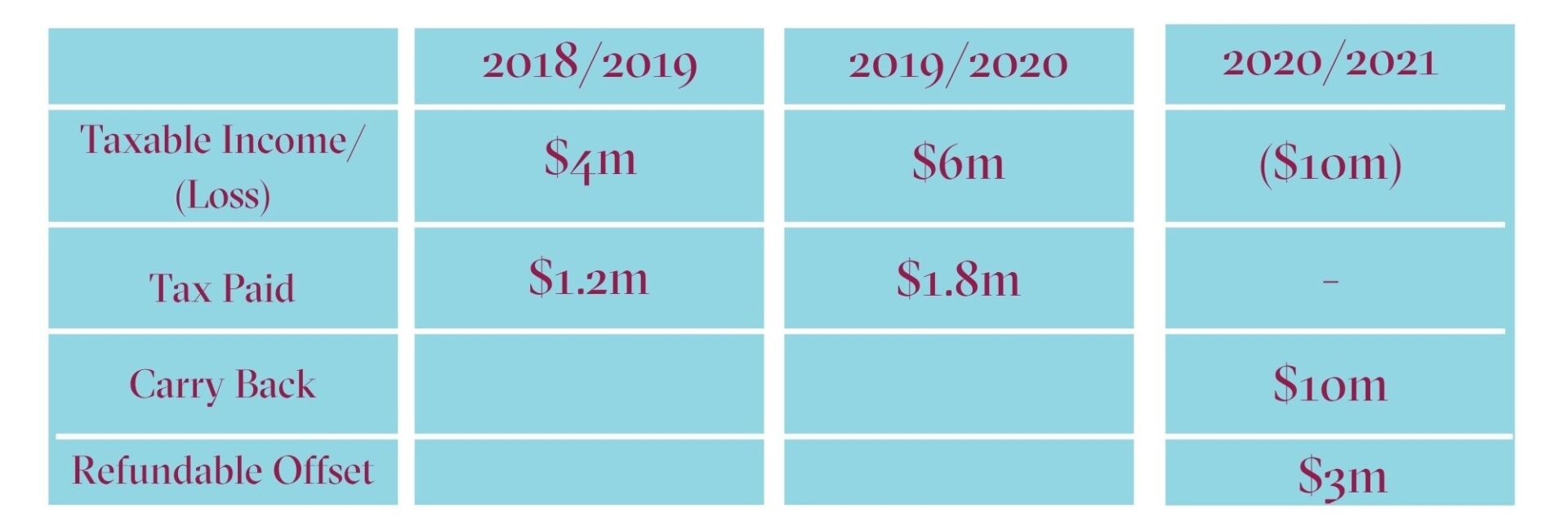

For example, ScoMo Pty Ltd’s results for the 2018/19 to 2020/21 have been summarised below:

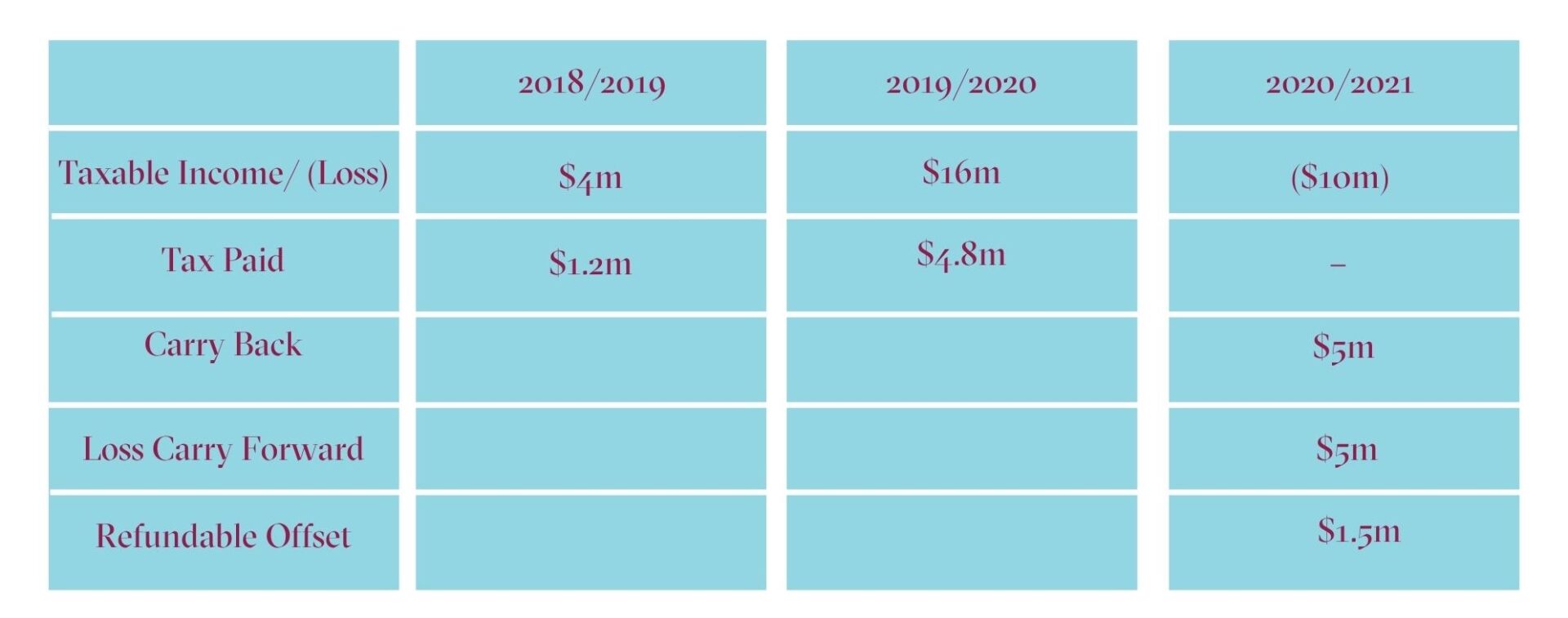

If, however, ScoMo Pty Ltd had paid a dividend of say $3.5m in the 2019/20 year giving rise to a franking debit of $1.5 million the result would be slightly different. Assume the franking account was $1.5 million after allowing for the franking debit attributable to the dividend paid in 2019–20.

Under loss carry-back, ScoMo Pty Ltd can choose to carry-back only $5 million of the $10 million loss because of the limiting factor of the franking account. The balance of the loss, i.e. $5m can be carried forward under the normal rules.

The impact of the above, especially the timing and limitations arising through the franking account given potential deferrals of tax, will need to be carefully considered to ensure that the maximum benefit is obtained including the interaction with the instant asset write off provisions extended by the Budget.

If you are unsure of how you can apply the Loss Carry Back provisions to your circumstances, please speak to your ESV Engagement Partner.