The Federal Government has finally released what is (hopefully) the last Legislative Instrument relating to the implementation of JobKeeper 2.0, which officially commences next Monday. This new instrument outlines the situations in which an entity can satisfy the “actual decline in GST-turnover” requirement to remain eligible for JobKeeper 2.0, in circumstances where the basic rules do not (or cannot) necessarily apply.

The comfort to be taken from the latest legislative instrument is that it is essentially a repeat of the earlier legislative instrument for the alternate tests (which it replaces) and is in line with the historical announcements. As such, most of the concepts are already known and understood, however, there are some specific amendments which are designed to be concessional.

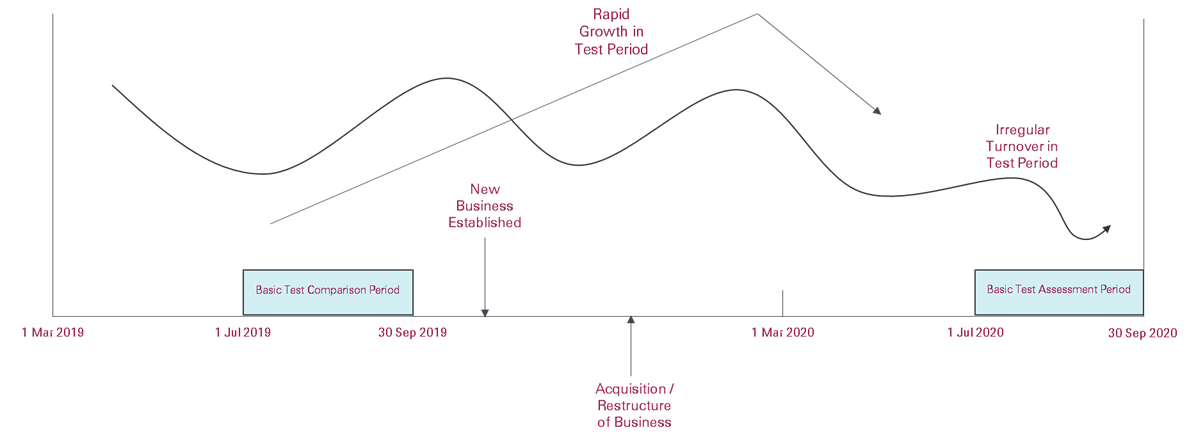

The Instrument outlines a number of different scenarios which may apply, as illustrated below in reference to the first JobKeeper 2.0 extension period:

Similar to the Alternative Tests released for the original implementation of JobKeeper, these revised Alternative Tests aim to provide greater availability for businesses to continue to access the scheme. Additional availability is also given to businesses who have been affected by natural disasters and sole traders / partnerships who experienced sickness, injury or leave over the basic comparison periods.

Each Alternative Test has its own set of assessment criteria, which in most cases involves an averaging of GST-turnover periods, or a shift in the timing of the particular assessment period.

Other key points to note from the latest announcement:

-Businesses who accessed JobKeeper 1.0 originally via the Basic Test can utilise the Alternative Test for JobKeeper 2.0 purposes, and vice versa.

-Additional benchmark dates have been included for the “Substantial Increase in Turnover” and “Irregular Turnover” tests, allowing further scope for businesses to access the JobKeeper payment.

-Businesses who have experienced multiple acquisitions, disposals or restructures can apply the test at the end of any one of the transactions.

-Businesses can utilise these updated Alternative Tests where they have not yet registered for the JobKeeper regime. As with the Basic Test, entities have up to the December quarter to register for JobKeeper where the “actual” tests are satisfied – whether Basic or Alternative.

Due to the GST-turnover figures aligning with BAS disclosures, along with monthly disclosures having been made as part of the JobKeeper process, the ATO will be able to readily ascertain where businesses have not satisfied the Basic Test. The utilisation of Alternative Tests, due to the wide scope of availability, may be an area which attracts the ATO’s attention over coming months. As such, as with all JobKeeper assessments, we strongly recommend records are kept confirming an entity’s accessibility to JobKeeper 2.0 where the Alternative Tests are employed.

With JobKeeper 2.0 only days away, we hope that this concludes the ATO’s release of legislation. The next step is ensuring that your business knows its eligibility position (and which payment tiers their employees are on) in time for the commencement of JobKeeper 2.0 on 29 September 2020.

As always, if you have any questions regarding the announcement of the revised Alternative Tests, please do not hesitate to reach out to your ESV Engagement Partner.