The Federal Government has released the Legislative Instrument regarding the extension of JobKeeper for the period following 28 September 2020 (“JobKeeper 2.0”). The instrument aligns with most of the preliminary guidance released by the ATO in recent weeks, however, it’s still only part of the information required as details concerning the alternative turnover tests are still to be released.

As ever, the devil is in the detail in relation to these matters, however, to assist in digesting the announcements and how they may impact your business, we have provided a FAQ summary below. We will provide further updates as more information comes to light which is anticipated to be over the coming days.

What is the time period for JobKeeper 2.0?

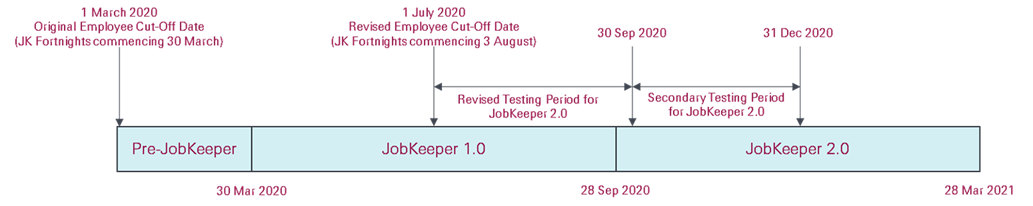

The two extension periods for JobKeeper 2.0 will run from:

-28 September 2020 to 3 January 2021 (“Extension 1”); and

-4 January 2021 to 28 March 2021 (“Extension 2”).

How does an entity remain eligible for Extension 1 and Extension 2 (for standard situations where the Basic Test was satisfied for JobKeeper 1.0)?

For Extension 1, entities will need to satisfy an actual decline in GST-turnover for the quarter to 30 September 2020, compared to the corresponding period in 2019. For Extension 2, the comparison will be conducted in a similar fashion to Extension 1, however the comparison quarter will be the quarter to 31 December, rather than 30 September.

For most entities which are not charities or have turnover exceeding $1 billion, the decline in turnover rate will be 30%.

How does this actual turnover test work when having utilised an Alternative Test to access JobKeeper 1.0?

This has not yet been confirmed – we expect further guidance within the coming days.

Can an entity register for JobKeeper for the first time in Extension 1 or Extension 2?

Yes, provided the entity passes both the original projected GST-turnover test and the new actual decline in GST-turnover test (referred to above).

It is strongly recommended that assessment of eligibility occur at the earliest possible opportunity, to maximise the number of potential JobKeeper fortnights available to them. As such, ongoing testing should be undertaken (even if the September threshold is not met).

Can a business become eligible once again for Extension 2, having failed Extension 1?

Yes, provided all other relevant criteria are met.

Does a business use the same rate (i.e. 30%) as they did for original JobKeeper eligibility, when assessing eligibility for Extension 1 or Extension 2?

In most cases, yes. This will not be the case however where the circumstances change significantly for an entity. As an example, if an entity became a charity during the year, they would utilise the 15% rate rather than their original 30% eligibility rate.

A similar adjustment may also be required where an entity became/ceased to be a Significant Global Entity (where prior year aggregated turnover exceeded $1 billion).

What are the new rates of JobKeeper?

| Current Rules | Extension 1 | Extension 2 | |

| Higher Rate | $1500 per fortnight | $1200 per fortnight | $1000 per fortnight |

| Lower Rate | $1500 per fortnight | $750 per fortnight | $650 per fortnight |

When is an employee eligible for the Higher Rate above?

An employee will be eligible for the Higher Rate where their “hours worked” in the 28 days preceding 1 March 2020 OR 1 July 2020 exceeded 80 hours (i.e. an average of 20 hours per week). This gives employees two distinctly separate opportunities to access the Higher Rate. An employer must use the Higher Rate for an employee if they meet the higher rate threshold in either period.

What is considered “hours worked”?

This includes actual hours worked, plus most forms of paid leave and paid public holidays. The Commissioner has been given the ability to give discretion where employees do not fit within this threshold (for example, this may apply where an employee was on unpaid leave for bushfire purposes in February 2020 and on unpaid maternity leave in June 2020).

How does my monthly pay cycle tie into the 28 day assessment window?

The hours should be attributed on a pro rata basis across the monthly pay cycle.

What are the obligations of the business regarding these new rates?

The employer must notify the ATO which payment rate applies for each eligible employee in Extension 1 and 2 – we expect this to occur as part of the Single Touch Payroll obligations of the business.

Additionally, the business must notify the employee of their relevant payment rate within 7 days of making this above notification to the ATO.

What next?

For businesses already in JobKeeper (and for those considering entering into JobKeeper), the following two steps will be essential in the coming weeks:

-Assessment of the actual quarterly GST-turnover for September 2020 (compared to 2019); and

-Assessment of the hours worked by employees in the relevant reference period (being the 28 days preceding 1 March or 1 July 2020).

As always, if you require assistance regarding these changes to JobKeeper or have questions regarding how it will impact your business, please do not hesitate to reach out to your ESV Engagement Partner.