In response to the tighter lockdown restrictions imposed on Victoria this week, the Treasurer Josh Frydenberg announced a number of major changes to the JobKeeper program. Whereas most recent announcements have related to the second phase of JobKeeper starting on 28 September 2020 (known as JobKeeper 2.0), today’s announcements have major implications for all businesses currently receiving the JobKeeper subsidy (JobKeeper 1.0).

The changes announced represent a backflip on the previously announced multiple tier turnover testing to access JobKeeper 2.0 but still retain the requirement for businesses to demonstrate an ongoing decline in turnover. The changes announced also reflect that the Federal Government appreciates that the recovery is unlikely to be a V or U-shaped curve and be more akin to a W shaped recovery. This is clearly displayed in the changing reference date for employees to be eligible for the JobKeeper program (versions 1.0 and 2.0).

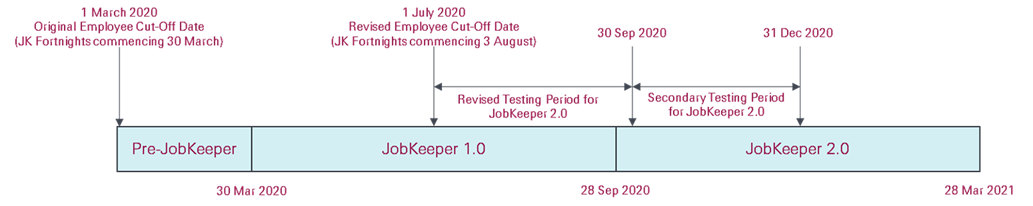

Whilst there will be more detail to follow, today’s announcements can be summarised in the diagram below:

Key changes:

- For JobKeeper fortnights commencing after 3 August 2020, the previous employee cut-off of 1 March 2020 has been replaced with 1 July 2020. This means that employees commencing between 1 March 2020 and 1 July 2020 will now be eligible employees for JobKeeper purposes. Importantly, this means employers will need to examine these new employees to determine whether they are eligible for the JobKeeper subsidy – by referencing the existing criteria as well as obtaining nomination forms etc.

- The testing period for eligibility of JobKeeper 2.0 has been revised, so that only the quarter ending 30 September 2020 is relevant (rather than both the June and September 2020 quarters) for the first extension period.

- The testing period to continue with JobKeeper 2.0 past 31 December (the second extension period) only now requires testing of the quarter ending 31 December 2020 (rather than all three of the June, September and December 2020 quarters).

The legislation regarding the major change in JobKeeper 1.0 employee eligibility has not yet been released which has created confusion as to what businesses should do right now. Given the JobKeeper subsidy operates on an “one-in, all-in” system and the changes apply to the existing JobKeeper program, it would appear that businesses will be required to meet the existing legislated requirements if they wish to receive a subsidy for these newly eligible employees. In other words, employers will need to ensure:

- The wage condition is met – employees should receive $1,500 per fortnight commencing from 3 August 2020;

- Newly eligible employees meet the other requirements for employee eligibility (i.e. permanent or long-term casual employees who satisfy the residency requirements);

- Ensure that the notification process (i.e. the declaration forms) is conducted similar to the process which occurred at the commencement of JobKeeper 1.0; and

- Ensure the correct payroll elections are confirmed on Single Touch Payroll.

Whilst the increased access to JobKeeper will be welcomed by many businesses, the diagram above highlights the complexities in ensuring compliance across the various combinations of scenarios which may arise. As always, the ESV team is staying on top of all announced changes to the JobKeeper program and will advise once these proposed changes become law.

Given the short notice and lack of legislation we anticipate the ATO may provide some concessional deadlines for the 3rd of August fortnight. Stay tuned for more on this.

If these changes weren’t enough for today, the ATO has also announced that there is only a short window of time left regarding the Superannuation Amnesty program ending on 7 September 2020. Busy times in the tax world!

If you have any questions regarding these changes, please do not hesitate to contact your ESV Engagement Partner on 02 9283 1666.