In a rapidly changing world where environmental, social and governance issues are taking centre stage, Australian businesses find themselves at a pivotal moment. The Australian Securities and Investments Commission (ASIC) has sounded the alarm: Prepare now for mandatory climate reporting.

Who will this affect and when?

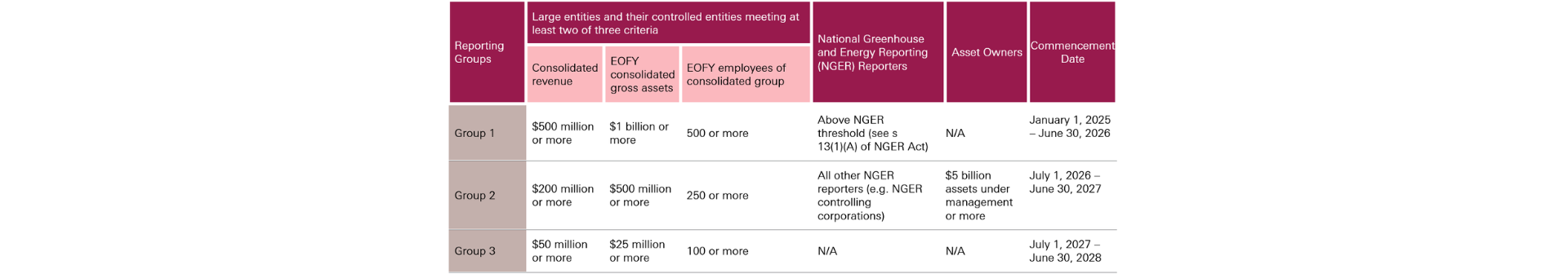

The proposed climate-related financial disclosure regime is set to come into effect on January 1 of next year and will be rolled out in phases based on the size of the entity:

Although your business may not be directly captured by the proposed reporting, we expect to see more strenuous questionnaires when you deal with businesses that do have to comply.

What are these new obligations?

While the details of the climate reporting bill are still unfolding, ASIC’s approach has been made clear: they will be pragmatic. They will issue guidance to help companies meet their obligations and work with the government and other agencies to support the implementation.

These reporting standards aim to assist companies in meeting the Australian government’s net zero by 2050 goal and its more immediate emissions reduction targets.

ASIC Chair Joe Longo has emphasised that businesses must start implementing systems, processes, and governance practices to meet these new obligations now.

How should you prepare?

- Assess your exposure: understand your climate-related risks and opportunities.

- Establish robust governance practices.

- Implement systems to collect relevant data.

- Model different climate scenarios to assess impacts.

The climate reporting regime isn’t just a compliance exercise; it’s an opportunity for Australian businesses to demonstrate leadership, resilience, and foresight. By preparing now, companies can navigate towards a sustainable future in which ESG considerations become a strategic imperative rather than just a trend.

Should you have any questions about how these changes will impact you please reach out to your Engagement Partner.