The recent reintroduction of the loss carry back provisions has increased the options available to companies to recover value from tax losses incurred, however, it has not replaced the original loss recoupment provisions which should not be forgotten.

Backwards

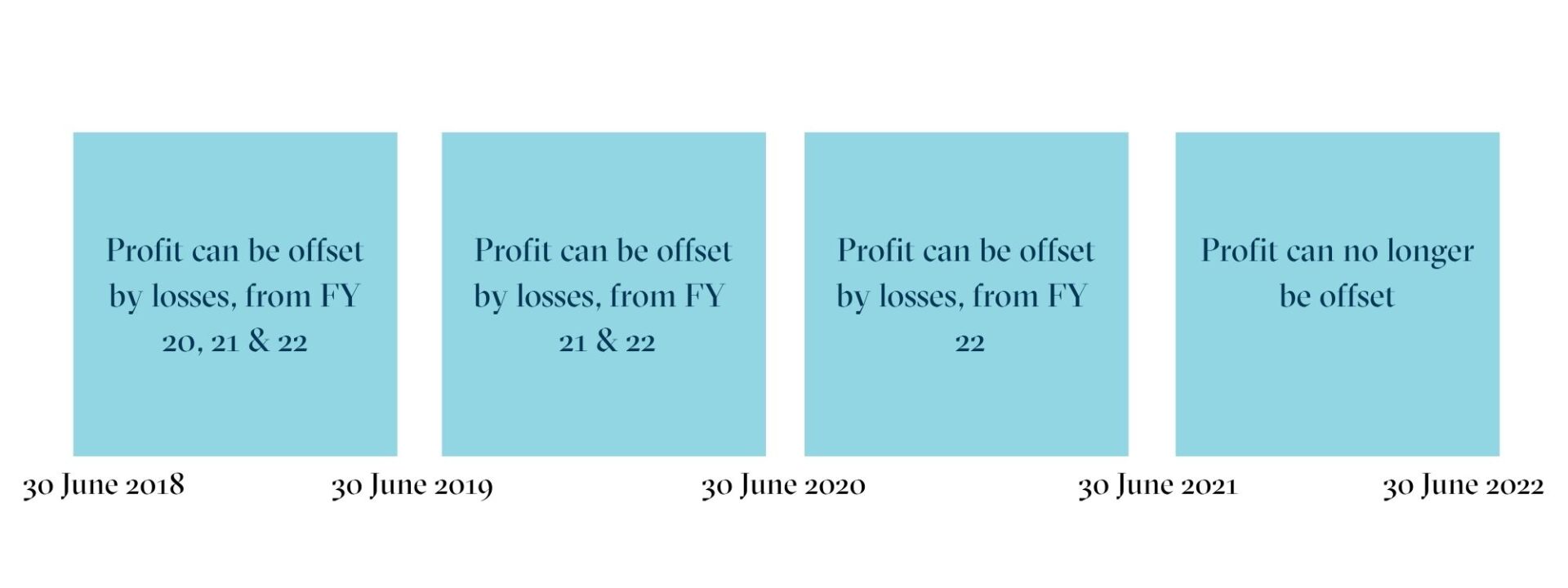

Starting with the loss carry back provisions recently introduced, these are the most effective way to realise value from corporate tax losses for entities with an aggregated annual turnover of less than $5 billion. Losses incurred in the 2019/20 to the 2021/22 income years can be carried back against taxable incomes from the 2018/19 to 2020/21 income years:

To the extent that a loss that is carried back, it will generate a refundable tax offset in the year in which the loss is made. Importantly, recent ATO guidance indicates that companies with a 30 June year end will only be able to carry losses back on lodgement of the tax return for the year ended 30 June 2021 even though this would incorporate the 30 June 2020 year. Other year ends will be subject to some transitional arrangements which are yet to be confirmed.

The losses able to be carried back are subject to limiting factors being

- the amount of earlier taxed profits; and

- the level of the franking account i.e. franking account deficit cannot be created

Forwards

So, what if the loss carry back is not available or there are excess losses still to be recouped? Well, that’s when you fall back into the original loss recoupment provisions which look forward to being able to be offset against future profits.

Where losses are to be recouped through future profits, companies are require to prove that more than 50.01% ownership has been maintained at the ultimate shareholder level (immediate holding company ownership is disregarded) from the start of the loss period to the end of the income period. In practice this time period is at least 2 years, likely longer subject to the recovery in profit levels. As such, ensuring documentation and records are maintained from the initial loss period is important.

Where continuity of ownership cannot be proven, companies will fall back on the Similar Business Test. This is a more relaxed testing requirement than the historical Same Business Test and provides companies with more flexibility concerning the evolution in development of the business to make a profit which will clearly be fundamental in the post COVID era. The application of the similar business test will become significant when companies take on new investors or have a change in ownership.

So where to from here?

Companies that have incurred losses should consider applying a three-step methodology as follows:

- Determine eligibility for the loss carry back provisions and quantum of losses for recoupment

- Where the carry back provisions are not available or do not fully extinguish the losses then establish the relevant shareholders for the start of the loss period and track relevant movements for ownership testing;

- Identify the business carried on when the losses were incurred as well as at the time of any potential change in ownership.

As such, starting to prepare your defence file should be a primary workflow as you look to emerge from the Covid era as the ATO will be seeking to recoup some of the money spent on Covid subsidies and denying tax losses is an easy win.

Should you have any questions about the availability and or recoupment of your losses, the development of loss recoupment documentation or associated matters please contact your ESV engagement partner.